Banks Pile Into Safer Bets

Some Banks Launch Services to Help Clients Navigate Changes in Derivatives

By Carrick Mollenkamp, Liz Rappaport, and Aaron Lucchetti

October 5 (Wall Street Journal)

October 5 (Wall Street Journal)

Tighter regulatory requirements are compelling giant investment banks in the U.S. and Europe to tone down their risk-taking and shift to more staid strategies. Now hot on Wall Street: trading securities for clients, processing trades, exchanging currency, managing assets and advising clients on deals and financing.

The latest example of this new pressure came Monday, when a Swiss bank panel recommended that the country's banks be forced to raise their capital cushion against risky assets by a higher margin than standards issued last month by a global bank-reform group. Analysts say U.S. regulators could take similar steps as they implement the Basel III Accord.

Adding to the urgency to adopt plain-vanilla strategies: a recent slowdown in the volume of U.S. stock trading, traditionally a big source of revenue. If this shift continues, analysts say, it will pinch profits but also lead to less risk for the financial system.

Investor presentations by top bank executives in London last week, combined with increasingly dour projections for the third quarter that ended Thursday, are crystallizing the challenges banks face.

"The business models on the Street are going through dramatic changes," says Clayton Rose, professor of management practice at Harvard Business School, based on the most drastic shifts in the "political, regulatory, and economic environment since the 1930s in the financial industry." Swiss government-appointed experts said tougher capital standards should be imposed on Switzerland's UBS, above, and Credit Suisse.

Even after near-death experiences in 2008, most Wall Street firms, until now, never really had lost their mojo. Following massive government bailouts, many securities firms generated huge profits in 2009, and were rewarded for taking big risks trading with their own capital. In this year's first quarter, Goldman Sachs Group Inc. notched nearly $10 billion in trading revenue—without a single day of trading losses.

Now, global investment banks are getting squeezed. Profit from securities trading plunged in the third quarter. In the bond market, for instance, investors were "paralyzed and trading desks fell silent during the quarter," research firm Sanford Bernstein said in a note last Thursday. The firm slashed per-share earnings estimates for Goldman Sachs and Morgan Stanley.

Stock trading has been especially hard hit as investors have grown cautious, partly over lingering concerns about the "flash crash" of May. In September, average daily trading in New York Stock Exchange composite volume was 3.9 billion shares, 23% less than in January, according to Market Data Web.

Dennis Berman discusses tighter bank regulations, which are compelling giant investment banks in the U.S. and Europe to tone down their risk-taking and shift more to plain-vanilla strategies for making money.

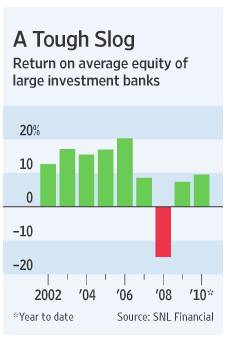

Return on average equity for the major investment banks, a key barometer of profitability, could be halved from the 20% range a few years ago, according to SNL Financial. And costs are rising, leading to expected waves of industry job cuts.

The latest example of this new pressure came Monday, when a Swiss bank panel recommended that the country's banks be forced to raise their capital cushion against risky assets by a higher margin than standards issued last month by a global bank-reform group. Analysts say U.S. regulators could take similar steps as they implement the Basel III Accord.

Adding to the urgency to adopt plain-vanilla strategies: a recent slowdown in the volume of U.S. stock trading, traditionally a big source of revenue. If this shift continues, analysts say, it will pinch profits but also lead to less risk for the financial system.

Investor presentations by top bank executives in London last week, combined with increasingly dour projections for the third quarter that ended Thursday, are crystallizing the challenges banks face.

"The business models on the Street are going through dramatic changes," says Clayton Rose, professor of management practice at Harvard Business School, based on the most drastic shifts in the "political, regulatory, and economic environment since the 1930s in the financial industry." Swiss government-appointed experts said tougher capital standards should be imposed on Switzerland's UBS, above, and Credit Suisse.

Even after near-death experiences in 2008, most Wall Street firms, until now, never really had lost their mojo. Following massive government bailouts, many securities firms generated huge profits in 2009, and were rewarded for taking big risks trading with their own capital. In this year's first quarter, Goldman Sachs Group Inc. notched nearly $10 billion in trading revenue—without a single day of trading losses.

Now, global investment banks are getting squeezed. Profit from securities trading plunged in the third quarter. In the bond market, for instance, investors were "paralyzed and trading desks fell silent during the quarter," research firm Sanford Bernstein said in a note last Thursday. The firm slashed per-share earnings estimates for Goldman Sachs and Morgan Stanley.

Stock trading has been especially hard hit as investors have grown cautious, partly over lingering concerns about the "flash crash" of May. In September, average daily trading in New York Stock Exchange composite volume was 3.9 billion shares, 23% less than in January, according to Market Data Web.

Dennis Berman discusses tighter bank regulations, which are compelling giant investment banks in the U.S. and Europe to tone down their risk-taking and shift more to plain-vanilla strategies for making money.

Return on average equity for the major investment banks, a key barometer of profitability, could be halved from the 20% range a few years ago, according to SNL Financial. And costs are rising, leading to expected waves of industry job cuts.

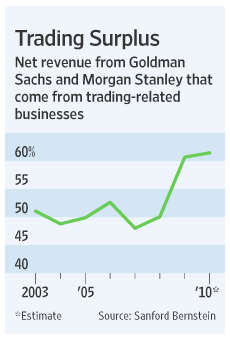

Morgan Stanley and Goldman, the two major firms that derive most of their earnings power from Wall Street businesses, are expected to earn about $12.1 billion in profits this year—23% less than in 2006, their peak earnings year, according to Thomson Reuters. Their revenues are still largely dependent on trading, with about 60% of 2009 and estimated 2010 revenues coming from trading, according to Sanford Bernstein.

The external pressures are acute. New international bank-capital requirements, called Basel III, are to be finalized next month. They will force many banks in the U.S. and Europe to jettison trading businesses, such as mortgage securities. If firms hold risky assets, they must set aside more capital as a buffer against losses.

Countries have some flexibility to adapt the rules to their own banks. Swiss banking experts began this process Monday. Their recommendations, if accepted, would force Switzerland's two major banks, UBS AG and Credit Suisse Group, to increase a key capital buffer to 10%, compared with a minimum of 7% set by global regulators at Basel.

Both banks said Monday they have plans to deal with these recommendations.

The obligation to hold more capital "means that return on equity will go down," said Huw van Steenis, a bank analyst at Morgan Stanley in London. He predicts that return on equity could fall an average of 4% and potentially as far as 8% at investment banks in the U.S. and Europe.

Meanwhile, the new financial-regulatory law in the U.S. will require stricter standards and more transparency in the market for derivatives.

Derivatives are financial instruments that derive their value from the movement of something else—for instance, the level of interest rates or the price of commodities. In the past decade, the market soared for derivatives known as credit-default swaps—bets on a borrower's ability to repay a debt. Derivatives played a prominent role in the global financial crisis.

Under the new law, many derivatives will now be traded on exchanges, rather than in private transactions between dealers. This could make them far less profitable for Wall Street than the customized, off-market trades that ballooned this decade.

New, staid businesses requiring less capital are apt to stem from these regulatory changes. Credit Suisse in Zurich, for instance, is buying a hedge-fund administration services business from a Dutch bank to help hedge funds administer their accounts, communicate with investors, and calculate and finance their assets.

Some banks are launching services to help clients navigate changes in derivatives trading. Bank of America Merrill Lynch, the investment-banking unit of Bank of AmericaCorp., has assigned more than 200 traders, lawyers and other officials to work on a new derivatives-services business.

Goldman has launched a business to help clients process derivatives trades tied to interest rates, credit markets, foreign-exchange markets and commodities markets. Barclays Capital, the investment-banking unit of London's Barclays PLC, is identifying ways to profit as the industry tries to reduce derivatives risk by using trading clearinghouses.

The external pressures are acute. New international bank-capital requirements, called Basel III, are to be finalized next month. They will force many banks in the U.S. and Europe to jettison trading businesses, such as mortgage securities. If firms hold risky assets, they must set aside more capital as a buffer against losses.

Countries have some flexibility to adapt the rules to their own banks. Swiss banking experts began this process Monday. Their recommendations, if accepted, would force Switzerland's two major banks, UBS AG and Credit Suisse Group, to increase a key capital buffer to 10%, compared with a minimum of 7% set by global regulators at Basel.

Both banks said Monday they have plans to deal with these recommendations.

The obligation to hold more capital "means that return on equity will go down," said Huw van Steenis, a bank analyst at Morgan Stanley in London. He predicts that return on equity could fall an average of 4% and potentially as far as 8% at investment banks in the U.S. and Europe.

Meanwhile, the new financial-regulatory law in the U.S. will require stricter standards and more transparency in the market for derivatives.

Derivatives are financial instruments that derive their value from the movement of something else—for instance, the level of interest rates or the price of commodities. In the past decade, the market soared for derivatives known as credit-default swaps—bets on a borrower's ability to repay a debt. Derivatives played a prominent role in the global financial crisis.

Under the new law, many derivatives will now be traded on exchanges, rather than in private transactions between dealers. This could make them far less profitable for Wall Street than the customized, off-market trades that ballooned this decade.

New, staid businesses requiring less capital are apt to stem from these regulatory changes. Credit Suisse in Zurich, for instance, is buying a hedge-fund administration services business from a Dutch bank to help hedge funds administer their accounts, communicate with investors, and calculate and finance their assets.

Some banks are launching services to help clients navigate changes in derivatives trading. Bank of America Merrill Lynch, the investment-banking unit of Bank of AmericaCorp., has assigned more than 200 traders, lawyers and other officials to work on a new derivatives-services business.

Goldman has launched a business to help clients process derivatives trades tied to interest rates, credit markets, foreign-exchange markets and commodities markets. Barclays Capital, the investment-banking unit of London's Barclays PLC, is identifying ways to profit as the industry tries to reduce derivatives risk by using trading clearinghouses.